Balance Sheet Definition, Example, Formula & Components

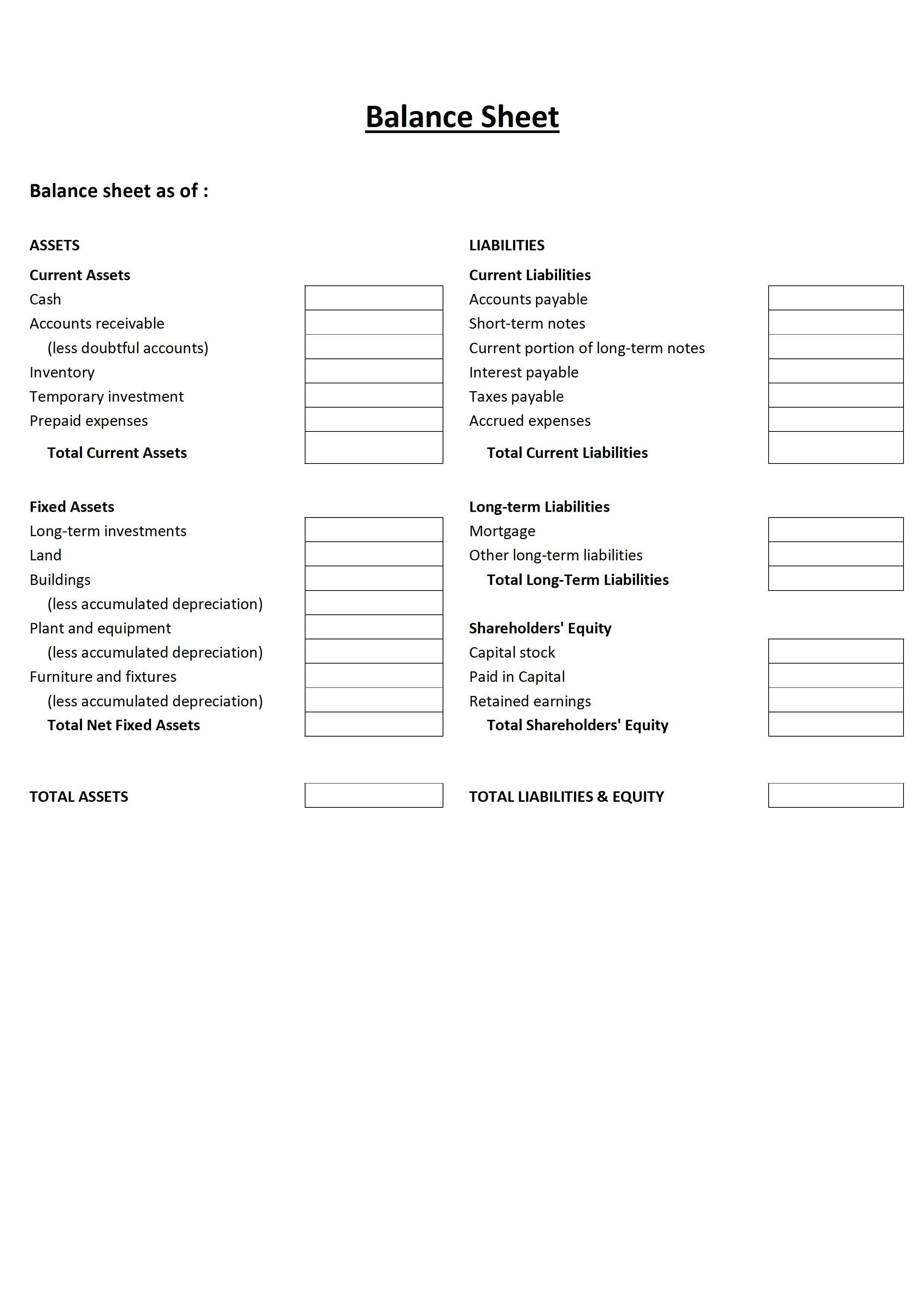

This means that the assets of a company should equal its liabilities plus any shareholders’ equity that has been issued. A bank statement is often used by parties outside of a company to gauge the company’s health. Accounts within this segment are listed from top to bottom in order of their liquidity. They are divided into current assets, which can be converted to cash in one year or less; and non-current or long-term assets, which cannot.

How Long-Term Assets Different from Current Assets on a Balance Sheet? – About Balance Sheets

Shareholders’ equity belongs to the shareholders, whether public or private owners. There are a few common components that investors are likely to come across. workflowmax job and project management software Balance sheets should also be compared with those of other businesses in the same industry since different industries have unique approaches to financing.

A Crucial Understanding

Accounts should learn how to analyze a balance sheet for the most insight. Thankfully, you can plug balance sheet information into various ratios for financial ratio analysis. So, while they can’t explain commercial trends, you can compare balance sheets to measure growth over time. A balance sheet gives an overview of a company’s financial position by taking stock of what it owns, what it owes and the value of its equity. A balance sheet is a key financial tool for business owners, executives, analysts and anyone who wants a clear picture of a company’s current monetary position.

Free Course: Understanding Financial Statements

You also have a business loan, which isn’t due for another 18 months. Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease. After enrolling in a program, you may request a withdrawal with refund (minus a $100 nonrefundable enrollment fee) up until 24 hours after the start of your program. Please review the Program Policies page for more details on refunds and deferrals.

- You can think of it like a snapshot of what the business looked like on that day in time.

- Leverage can also be seen as other people’s money you use to create more assets in your business.

- A positive net worth indicates that your business’s assets exceed its liabilities, which is generally a sign of financial health and solvency.

- In this balance sheet, accounts are listed from least liquid to most liquid (or how quickly they can be converted into cash).

Last, a balance sheet is subject to several areas of professional judgement that may materially impact the report. For example, accounts receivable must be continually assessed for impairment and adjusted to reflect potential uncollectible accounts. Without knowing which receivables a company is likely to actually receive, a company must make estimates and reflect their best guess as part of the balance sheet. Additional paid-in capital or capital surplus represents the amount shareholders have invested in excess of the common or preferred stock accounts, which are based on par value rather than market price.

Who prepares balance sheets?

Add your bank details so your customer can easily make the transaction. The ledger account template is used to view the sales amount received from a client. You can use the template to generate a party’s ledger account for a particular period and view how much money was transferred to your bank account. The columnar ledger account will help you have a detailed view of your sales figures, including the GST charged per sale.

On the other hand, balance sheets for mid-size private firms might be prepared internally and then reviewed over by an external accountant. It is helpful for business owners to prepare and review balance sheets in order to assess the financial health of their companies. It may not provide a full snapshot of the financial health of a company without data from other financial statements. Assets are typically listed as individual line items and then as total assets in a balance sheet. Below the assets are the liabilities and stockholders’ equity, which include current liabilities, noncurrent liabilities, and shareholders’ equity. Shareholder equity is the money attributable to the owners of a business or its shareholders.

When you’re starting a company, there are many important financial documents to know. It might seem overwhelming at first, but getting a handle on everything early will set you up for success in the future. Today, we’ll go over what a balance sheet is and how to master it to keep accurate financial records. If a balance sheet doesn’t balance, it’s likely the document was prepared incorrectly. External auditors, on the other hand, might use a balance sheet to ensure a company is complying with any reporting laws it’s subject to. Typically, a balance sheet will be prepared and distributed on a quarterly or monthly basis, depending on the frequency of reporting as determined by law or company policy.

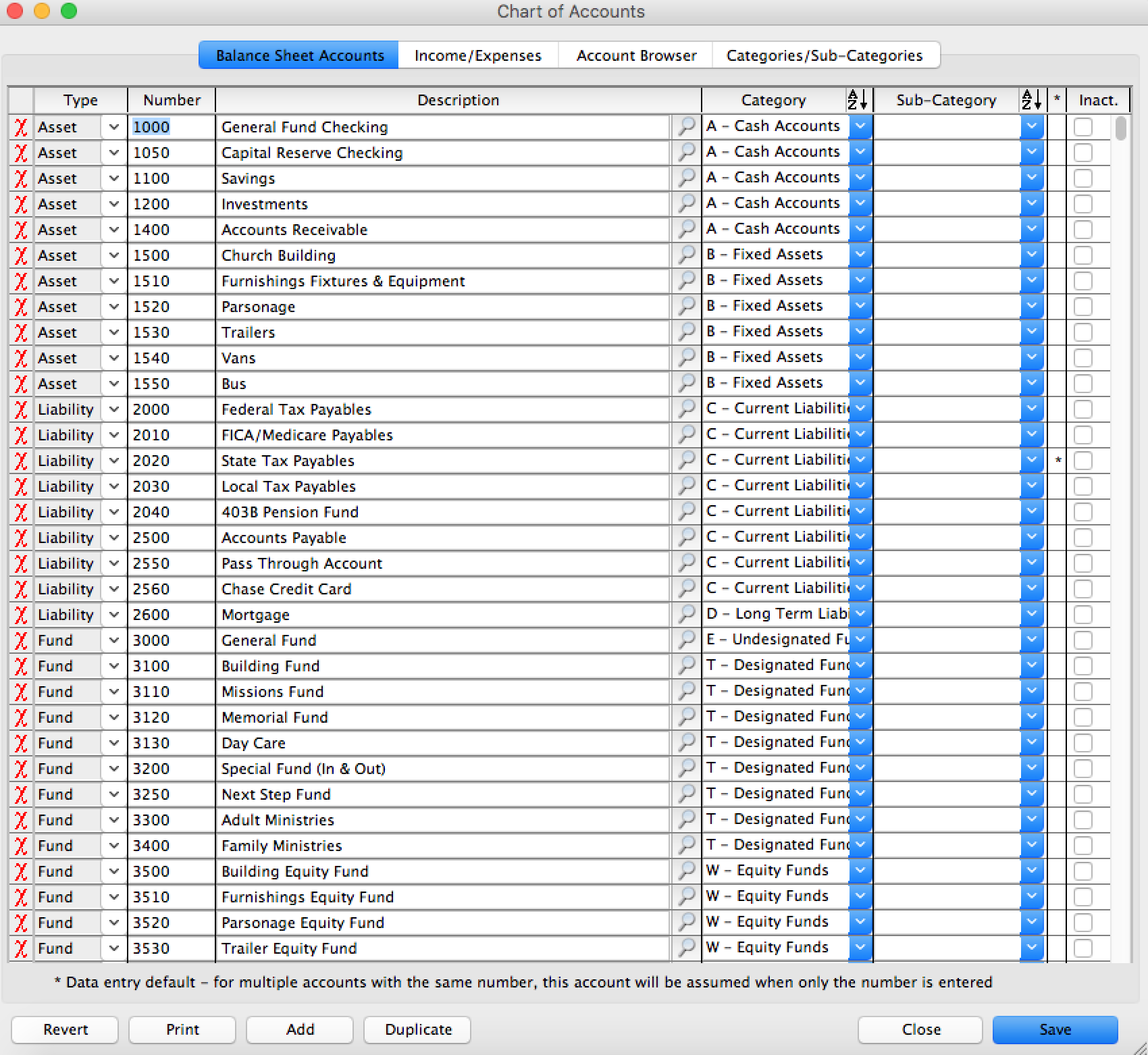

This is also why all revenue and expense accounts are equity accounts, because they represent changes to the value of assets. Assets will typically be presented as individual line items, such as the examples above. Then, current and fixed assets are subtotaled and finally totaled together. Balance sheets are typically prepared and distributed monthly or quarterly depending on the governing laws and company policies. Additionally, the balance sheet may be prepared according to GAAP or IFRS standards based on the region in which the company is located. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

Here’s what you need to know to understand how balance sheets work and what makes them a business fundamental, as well as steps you can take to create a basic balance sheet for your organization. Think of the account format like the accounting equation– left to right. Think about the report format like a report or spreadsheet–top to bottom.